What is E-Invoicing in UAE?

E-Invoicing (electronic invoicing) in the UAE is a digital system introduced to simplify, standardize, and secure how businesses issue, receive, and store invoices. It replaces paper-based invoices with structured digital files that can be easily validated by the Federal Tax Authority (FTA).

Is Your Business Required to Use E-Invoicing?

The E-Invoicing requirement applies to all VAT-registered businesses operating in the UAE. Whether you are a small enterprise or a large corporation, you need to ensure your billing and accounting system complies with FTA e-invoice standards.

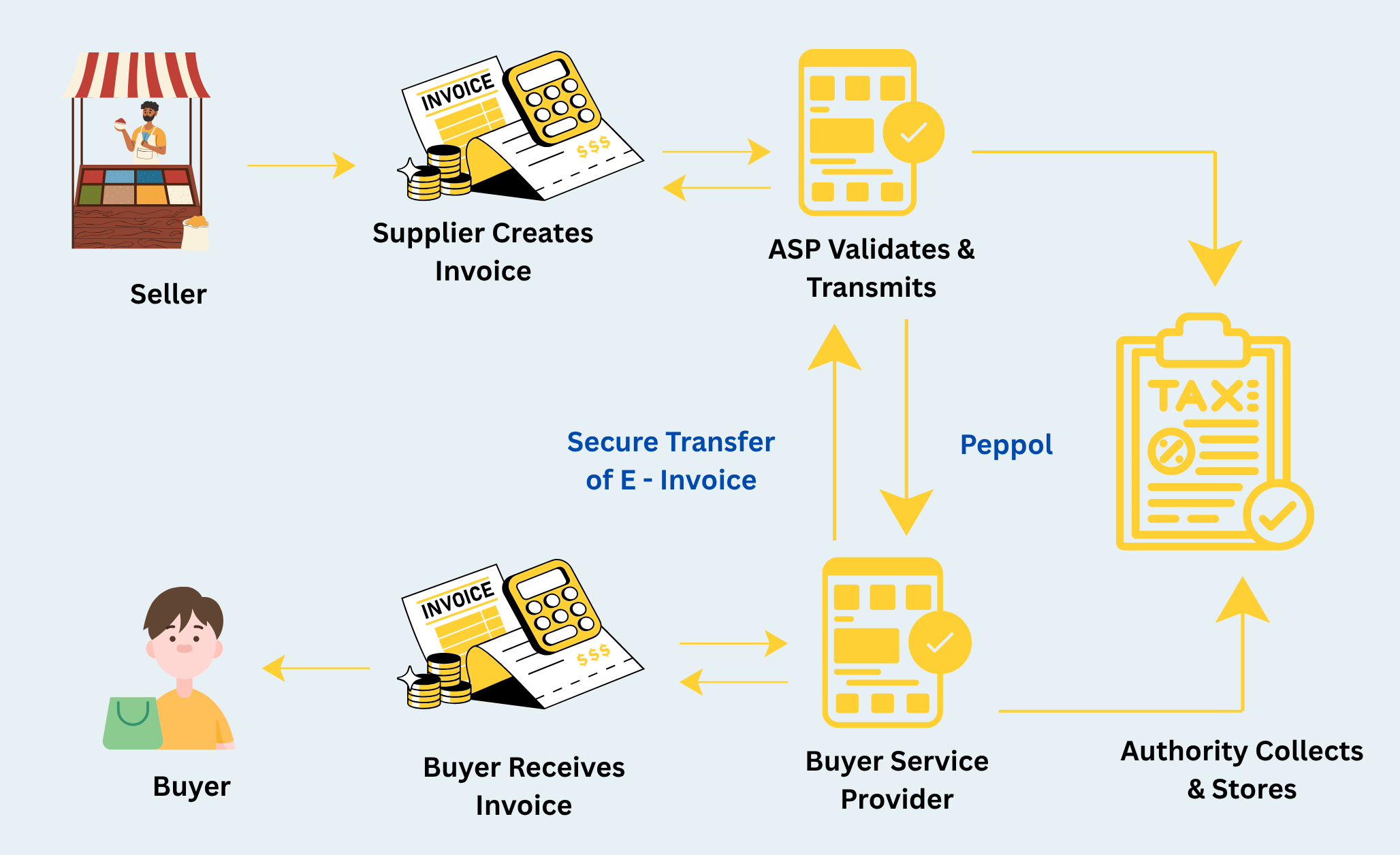

How Does E-Invoicing Work?

Every transaction generates an electronic invoice in a standardized XML or PDF/A-3 format containing all the necessary VAT details. The invoice is digitally signed and validated through the FTA portal, ensuring authenticity, accuracy, and transparency in business operations.

Benefits of E-Invoicing

- Ensures compliance with UAE VAT regulations.

- Reduces paperwork and manual errors.

- Speeds up reconciliation and audit processes.

- Improves transparency and business credibility.

How TallyPrime Helps

TallyPrime automates your E-Invoicing process — from generating FTA-compliant e-invoices to validation and reporting. With real-time synchronization, your business stays compliant while you focus on growth.

.png)

.png)